If you are a tenant in a rented apartment or home, your landlord’s insurance policy may not pay to replace or repair your belongings in the event of a loss. We know you still have property and valuables inside that are important to you. That is why it is important to have renters insurance.

What is renters insurance?

Renters insurance is intended for those people who are renting rather than purchasing their dwelling. Renters insurance is also known as an HO-4 policy and focuses on what is inside the rental and not the structure itself. While renters insurance is not always legally required, a landlord or apartment complex may require tenants to have a renters insurance policy before they are permitted to live in the rental.

Renters insurance can cover your personal property from loss due to fire and theft, as well as many other hazards including vandalism, tornadoes, lightning, etc. Renters insurance can also cover you if you become personally liable for claims such as bodily injury and damage to property belonging to others.

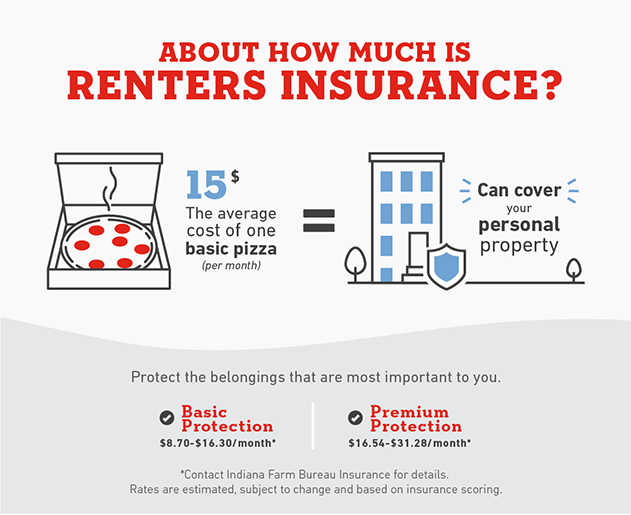

How much does renters insurance cost in Indiana?

What does renters insurance cover?

Coverage can be divided into two sections.

1. Personal property

Renters insurance can cover your personal property from loss. Personal property includes the personal belongings in your home, such as electronics, furniture, clothing, and other valuables.

There are events known as named perils that an insurance company identifies in a standard renters insurance policy to outline losses that may be covered for physical loss to the property:

Fire or lightning

Windstorm or hail

Riot or civil commotion

Aircraft

Explosion

Vandalism or malicious mischief

Damage caused by vehicles

Smoke

Damage caused by aircraft

Theft

Falling objects

Volcanic eruption

The weight of ice, snow or sleet

Accidental discharge of steam or water from within specific household systems or appliances

Sudden and accidental tearing apart, cracking, burning or bulging of specific systems or appliances

Freezing of a plumbing, heating, air conditioning or automatic fire protective sprinkler system or of a household appliance

Sudden and accidental tearing apart, cracking, burning or bulging of specific household systems

Specific sudden accidental damage from artificially generated electric currents

If the rental becomes inhabitable because of the above circumstances, reasonable living expenses such as hotel and restaurant bills may qualify for coverage.

Does renters insurance cover car theft?

Car theft is not covered by a renters insurance policy. Your car needs coverage provided by auto insurance. However, if a covered personal property item is stolen from your car, that item might be covered by your renters insurance.

There are some caveats of having standard coverage. A renters insurance policy will pay to replace your possessions based on actual cash value. For example, if an old bed needs to be replaced, the policy will cover the value of an old bed, not a new one.

What else is not covered under personal property insurance?

Insurance policies usually list what is not covered—or exclusions. Exclusions list causes or events that the insurance company does not insure.

These may include losses due to earthquake, water damage, power failure, neglect, wars, nuclear hazard, or intentional losses.

2. Personal liability and Medical Payments to Others

Renters insurance also provides coverage if you become legally liable for claims, such as bodily injury and damage to property belonging to others. Accident and negligence are key personal liability terms—learn more about renters insurance words you need to know.

Personal liability may cover situations such as:

Injuries - If a visitor falls or is accidentally injured while being in your apartment

Damage related to a social gathering - A primary example is someone who sets off a firework at a cookout and causes an accident

Property damage that is your fault - An example is if you accidentally break a neighbor’s window

Damage that starts in your rented home and affects a neighbor’s property - It could be a grill fire on your patio that accidentally spreads to another rental unit.

An animal bite - If your pet attacks a visitor. Make sure to check with your insurer as to which dog breeds your insurer covers.

Typical liability for renters liability insurance limits are between $100,000 and $500,000. Additional coverage options, such as personal umbrella policies, are also available.

We want you to be happy with the coverage that protects your personal belongings inside the apartment or home you are renting. Indiana Farm Bureau Insurance is here to help protect those possessions, and our company offers renters insurance at very affordable prices. It is worth your while to contact one of our agents or get a quote online today.

*The information in this article was compiled from a variety of sources and is intended to provide helpful tips only.